SEC Considering Rule Change to Allow New Carbon Credit Companies to be Traded on NYSE

By Sarah Clendenon • January 3, 2024The New York Stock Exchange (NYSE or The Exhange) has prepared a proposal for the Securities and Exchange Commission (SEC) to consider a rule change which would amend their company manual to allow a new type of company to be listed for sale and trade. They are called Natural Asset Companies (NACs).

The NYSE written proposal for the rule change defines an NAC this way:

“Natural Asset Companies (NACs) – Corporations that hold the rights to the ecological performance of a defined area and have the authority to manage the areas for conservation, restoration, or sustainable management.”

The proposal goes on to explain the policies that would be required of an NAC:

NAC Policies

Proposed Section 102.09 of the Manual would provide that a NAC seeking to list on the NYSE must adopt the following written policies (collectively, the “NAC Policies”) and post them on its website by the earlier of the date that the NAC’s initial public offering closes or five business days following the NAC’s initial listing date:

• An Environmental and Social Policy that articulates the objectives and principles that will guide the NAC to achieve sound environmental and social performance. As proposed, such policy must include requirements to conduct a process of environmental and social assessment, and establish, as soon as practicable after listing, an Environmental and Social Management System (“ESMS”).The ESMS should be designed to:

• Identify and assess environmental and social risks and impacts,

• Identify measures to avoid, minimize and mitigate the negative risks and impacts, and

• Promote improved environmental and social performance.

• A Biodiversity Policy that articulates a commitment to achieving no net loss, and where possible a net positive impact on biodiversity. The Biodiversity Policy should be based on the mitigation hierarchy, a planning and management approach for addressing impacts to biodiversity and ecosystem services through avoidance, minimization, restoration, and offsetting.

• A Human Rights Policy that articulates a commitment to human rights, consistent with the United Nations Guiding Principles on Business and Human Rights, including a commitment to recognize and respect people’s rights in accordance with customary, national, and international human rights laws, in particular those of indigenous peoples.

• An Equitable Benefit Sharing Policy that articulates the NAC’s commitment for sharing benefits with local communities. A NAC must include in its license agreement with the licensor a provision requiring the licensor to comply with the applicable terms of the Equitable Benefit Sharing Policy. The Exchange proposes that Equitable Benefit Sharing Policy must require an equitable benefit sharing arrangement for the distribution of shares of the NAC’s common stock to local communities, which the Exchange states would be those who have direct ties to and derive livelihood or cultural values from the applicable area. As proposed, the NAC’s common stock distribution would be required to be completed no later than the time of closing of the NAC’s IPO and meet the following requirements at a minimum:

• If the NAC has entered into a license agreement with respect to public lands, shares representing at least 50% of the shares of the NAC’s outstanding shares as of the closing of the IPO must be distributed to local communities.

• If the NAC has entered into a license agreement with respect to private lands, shares representing at least 5% of the shares of the NAC outstanding as of the closing of the IPO must be distributed to local communities.

The entire proposal can be seen here:

The proposal was published for public comment in October 2023. You can view the comments made here.

The SEC had originally planned to make a decision by January 2, 2024, but has pushed the decision back due to concerns by the public and by members of the U.S. Congress.

According to this article,

U.S. House members have accused the Securities and Exchange Commission of fast-tracking a plan to create a new class of investment firms that would let foreign companies lock up resource-rich land in the U.S.

The proposal is complex and potentially far-reaching, according to lawmakers. Companies would invest in “ecosystem services,” such as clean water, wildlife habitat and “climate stability.”

The state treasurer of Utah is quoted in this article, voicing grave concerns,

“Utah’s state treasurer, Marlo Oaks, a critic of the proposal, said in a statement that he was encouraged the SEC would scrutinize, rather than rubber stamp, natural asset companies. The proposal would allow investment funds controlled by foreign countries to manage farmland and public lands and stop economic activities, he said.

“The proposed creation of natural asset companies is one of the greatest threats to rural communities in the history of our country,” Oaks said.”

U.S. Senators for Idaho Mike Crapo and Jim Risch have also expressed serious concerns and asked questioned of the SEC. In a letter sent in November, they, along with U.S. Senator for Nebraska Senator Pete Ricketts, wrote,

“The proposed rule would allow for federal lands, including national parks and other publicly owned lands, to be included in private investment portfolios. The proposed rule also allows for NACs to have management authority over assets held in the portfolio, including our public lands. In the proposed rule, the SEC is creating a new incentive for non-government corporate control over our publicly shared lands.

We are concerned that corporate involvement in the stewardship and control of our federal lands would create unintended consequences. The proposed rule could lead to a preservationist-only approach to federal land management instead of an “all-of-the-above” working lands approach as intended by the creation of our federal land programs.

We are also alarmed by the SEC’s allowance under the proposed rule of foreign investment in these uniquely U.S. assets. At a time in which we are actively working to deter our adversaries, we should not be open our federal lands up to investment from the same adversaries.”

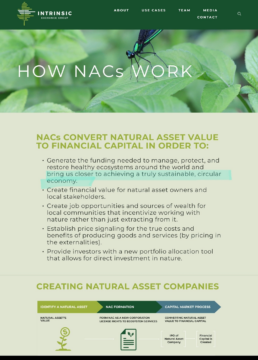

Author and Speaker James Lindsay wrote several posts on Twitter regarding NACs. He shared this graphic from Intrinsic Exchange Group (IEG) explaining what an NAC is. IEG is reportedly a Delaware private company who created the NAC concept.

In Lindsay’s lengthy explanation on his Twitter page, he mentioned,

“…the “Stakeholders” could turn off the water in Western states like Idaho, Utah, Nevada, Arizona, and California through NAC control of massive tracts of public land, collapse farms, etc., squeeze people into cities, and turn a huge profit off the crisis.”

Additional information on NACs can be found here at Regulations.gov, which explains,

“Ending the overconsumption of and underinvestment in nature requires bringing natural assets into the financial mainstream. To that end, the Exchange proposes to adopt listing standards to introduce a new type of public company called a NAC, a new concept pioneered by Intrinsic Exchange Group Inc. (“IEG”). Founded in 2017, IEG is a private company structured as a corporation organized under the laws of the State of Delaware that advises public sector and private landowners on the creation of NAC structures and strategies.

NACs will be corporations that hold the rights to the ecological performance (i.e., the value of natural assets and production of ecosystem services) produced by natural or working areas, such as national reserves or large-scale farmlands, and have the authority to manage the areas for conservation, restoration, or sustainable management. These rights can be licensed like other rights, including “run with the land” rights (such as mineral rights, water rights, or air rights), and NACs are expected to license these rights from sovereign nations or private landowners.

Under the proposed amendments to the Manual, capital raised through an NYSE-listed NAC’s initial public offering or follow-on offerings must be used to implement the conservation, restoration, or sustainable management plans articulated in its prospectus, fund its ongoing operations, or otherwise fulfill its purpose to maximize ecological performance (i.e., the value of natural assets and the production of ecosystem services). While a core purpose of a NAC is to maximize ecological performance, under the proposed rules, a NAC would also be required to seek to conduct sustainable revenue-generating operations ( e.g., eco-tourism in a natural landscape or production of regenerative food crops in a working landscape) provided that such operations are consistent with the NAC’s charter and do not cause any material adverse impact on the condition of the natural assets under the NAC’s control and seek to replenish the natural resources being used. Therefore, all NACs are prohibited from directly or indirectly conducting unsustainable activities, such as mining, that lead to the degradation of the ecosystems it is trying to protect. In conducting its revenue-generating operations, a NAC could monetize ecosystem services that have markets (e.g., through the sale of carbon credits). All revenues and expenses would be reported in the financial statements of the NAC prepared under generally accepted accounting principles (“GAAP”) and filed with the SEC as part of the NAC’s required annual report on Form 10–K, 20–F or 40–F, as applicable. In order to align the interests of local communities with the objectives of maximizing the value of natural assets and the production of ecosystem services, a NAC would also be able to use its funds for activities that support local community well-being (e.g., education, health), provided that such activities are sustainable.”

Tags: Agenda 2030, Biodiversity Policy, Carbon Credit, Equitable Benefit Sharing Policy, ESG, Human Rights Policy, James Lindsay, Jim Risch (R-Idaho), Marlo Oaks, Mike Crapo (R-Idaho), NAC, Natural Asset Companies, New York Stock Exchange, NYSE, SEC, Securities and Exchange Commission, Sustainability, Sustainable Development, UN, United Nations, Utah Treasurer

14 thoughts on “SEC Considering Rule Change to Allow New Carbon Credit Companies to be Traded on NYSE”

Comments are closed.

This article might appear to be “technical” and obscure, but it is another clear example of the fascism that the left has adopted. I have been telling people that we need to stop yelling “communist!” and call the left the New Fascists, which by definition includes BLM, Antifa, and their supporters in the Biden Administration. I doubt that Idaho’s senators know this or have the stuff to point this out publicly.

Your probably right.

When do you ever see a Idaho leader actually lead something.

Maybe someone should let them know standing in the back of a full room of people is not leading anything.

They are elected officials, “public servants” NOT leaders. We the People are suppose to be over seeing them but have neglected and failed miserably. TacticalCivics.com is working to turn this kind of thinking back to original intent.

Rene, I think it is ”We’ who are the public servants! These politicians get paid very well for their services! They become rich after a couple of terms of their employment. Remember, they are employed and paid by the people. I think we all should stop calling them public servants. When they are not receiving a pay check I’ll call them ‘servants’ but not until that happens!

Our politicians are a crime gang owned by corporations . Look up who owns them and why they decide what they decide.

ESG or Extreme Satanic Governance on a grand scale.

Remember Idaho’s Governor is pretty much clueless on this subject as are many of Idaho’s politicians.

The Cure: Simply lower funding to the SEC until they stop their new One World Order nonsense.

Al Gore is going to love this! If he is still mucking about in the carbon credits brokerage scam, this will elevate him and the whole “carbon credit” ruse to an obscene level.

Public Comment period has been extended. Encourage the SEC to vote AGAINST implementing this proposed rule – https://www.sec.gov/comments/sr-nyse-2023-09/notice-filing-proposed-rule-change-amend-nyse-listed-company-manual-adopt#no-back

If they succeed, any freedoms we have left will vanish. Digital “currency” one world government

“CARBON CREDITS” climate “crisis” bullshit….

Idaho could have some chance in remaining free but I’ve ZERO confidence in Simpson Little etc…

We are so f’d.

Piles of BS covering the confiscation of all lands for the super rich oligarchs. Returning to feudal times as quickly as the public private partnership (fascism by definition) can get us there. The globalists have bought the world’s governments at every level. It is time to take our world back. Over 30 shows of solutions in our modern world. We are empowered much more than we realize to make a difference. Creating projects to help each other. https://www.corbettreport.com/2023solutions/

I see in Chad’s comment that public comment period has been extended. DO IT!!! It’s the least we can do.

Anything they decide to do in these times is intended to take away all of our freedoms. We have had climate change from the time of creation. It’s called 4 seasons. Everything they do trying to change the climate is only another way to take from the people, WHO THEY ARE NOT REPRESENTING! Without carbon, none of us would even BE. Stay out of the carbon credits, God did not do anything wrong. It’s time we all go back to God’s WORD, the Bible

This would be another government complicit disaster that would be used as an economic weapon to enslave Americans and allow enemies to acquire our lands and control all of our resources, in the name of the environment. Any study would be a book cooking recipe of corruption that would level false charges against honest working Americans and steal their land and lives. It’s the Greening of Wall Street to become a fake enviro caretaker that really wants to steal the jewels. How many idiots will fall for it? Too many!