Investigative Report: Chatham Asset Management / McClatchy Media Network / The Idaho Statesman

By Sarah Clendenon • June 21, 2023Investigative Report: Idaho Dispatch is digging into who owns the newsrooms in Idaho. Who controls what the public sees and hears? Who decides what information is worthy of publishing? What is the culture of these organizations, and what are the factors in their decision-making?

See the previous articles in the series here, here, and here.

The hedge fund company Chatham Asset Management owns McClatchy Media Network, which owns The Idaho Statesman.

Chatham purchased McClatchy three years ago at auction after McClatchy filed Chapter 11 Bankruptcy.

From a 2020 New York Times article,

“Last week… Chatham emerged as the winning bidder in a bankruptcy auction for the McClatchy Company, a chain with 30 media outlets including The Miami Herald, The Kansas City Star, and The Sacramento Bee. With roots going back to 1857, McClatchy, a consistent winner of top journalism awards, was one of the last major family-run news publishers.”

AdvertisementFrom the Idaho Statesman ‘About’ page,

“In 2020, McClatchy transitioned to private ownership when it was acquired by Chatham Asset Management. The Chatham acquisition marked the beginning of a new era of opportunity for McClatchy, strengthening the Company’s financial position and enabling it to build on its 150-plus year history of independent, community-focused journalism by investing in local newsrooms.”

AdvertisementChatham also owns majority shares in Postmedia Network Canada Corp., a Canadian media company. According to this source,

“Here’s your reminder that every single one of these news outlets is owned by Chatham Asset Management, an American hedge fund.”

Part Two of this Idaho Dispatch series showed you how media companies are handling the new ESG/DEI aspect of the marketplace. Here is the page for McClatchy’s recruitment products where they offer assistance to companies in promoting job openings to minority groups, which in their words is a good way to virtue signal:

“…if your company sells to government agencies, educational institutions, and other large enterprises, the Diversity, Equity and Inclusion Package may help you demonstrate outreach to diverse audiences.”

Much of the McClatchy Twitter account showcases their partnership with Historically Black Colleges and Universities (HBCU).

Anthony Melchiorre is the founder and principal owner of Chatham Asset Management. You can view the holdings and market activity of Chatham here: Chatham Asset Management, Llc Net Worth (2023) – GuruFocus.com

In April of this year, the United States Securities and Exchange Commission put out this press release which details charges against Chatham and Melchiorre for “improper trading of certain fixed income securities.” SEC.gov | SEC Charges Chatham Asset Management and Founder Anthony Melchiorre for Improper Fixed Income Securities Trading

Details of the charges against the company are explained therein, and the release reports that,

SEC PR“Chatham and Melchiorre agreed to pay more than $19.3 million in combined disgorgement, prejudgment interest, and civil penalties to settle the charges.”

You can view the entire SEC findings and order here:

ORDER INSTITUTING ADMINISTRATIVE AND CEASE-AND-DESIST PROCEEDINGSChatham and Melchiorre also own and control American Media Inc./a360 Media LLC which produces US Weekly and The National Enquirer. The order explains,

“This matter arises from Chatham’s and Melchiorre’s trading, on behalf of their fund clients, in three high-yield debt securities issued by American Media Inc. (“AMI”), a wholly-owned subsidiary of AMI Parent Holdings, LLC (“AMI Parent”).

At times, from 2016 through 2018, Chatham and Melchiorre engaged in transactions in these AMI debt securities (the “AMI Bonds”) that resulted in one Chatham fund selling AMI Bonds and a different Chatham fund purchasing the same AMI Bonds, through various broker-dealers (the “Rebalancing Trades”).

Chatham engaged in the Rebalancing Trades to address portfolio constraints such as industry or issuer fund concentration limits, to meet investor redemptions, and to allocate capital inflows and outflows. These trades were executed at prices Chatham and Melchiorre proposed.

Over time, the prices at which Chatham and Melchiorre traded the securities in the Rebalancing Trades increased at a significantly higher rate than the prices of similar securities. Chatham’s and Melchiorre’s trading in the AMI Bonds accounted for the vast majority of the trading in those Bonds and therefore over time had a material effect on their pricing.”

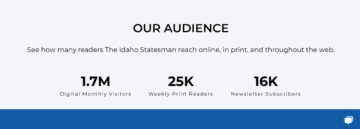

According to McClatchy’s advertising site, the reach of the Idaho Statesman is 1.7 million digital monthly visitors, 25,000 weekly print readers, and 16,000 newsletter subscribers.

Tags: Anthony Melchiorre, Chatham Asset Management, Civil Penalties, DEI, Disgorgement, Diversity, Equity, ESG, HBCU, Hedge Fund, Historically Black Colleges and Universities, Idaho Statesman, Improper Trading, Inclusion, McClatchy Media Network, Post Media News, Prejudgment Interest, SEC, Securities and Exchange Commission

3 thoughts on “Investigative Report: Chatham Asset Management / McClatchy Media Network / The Idaho Statesman”

Leave a Reply

If you’d like to see just how “independent” much of our “local” Idaho media is, watch this. “Local” news outlets reporting the same thing, verbatim:

https://youtu.be/ksb3KD6DfSI

Great research.

The Idaho Statesman has continually been a propaganda machine for decades. Doesn’t matter who has owned it, it’s basically a useless rag. At the peak of worthlessness now, an Idaho Statesman’s bankruptcy will be more than welcomed by most.