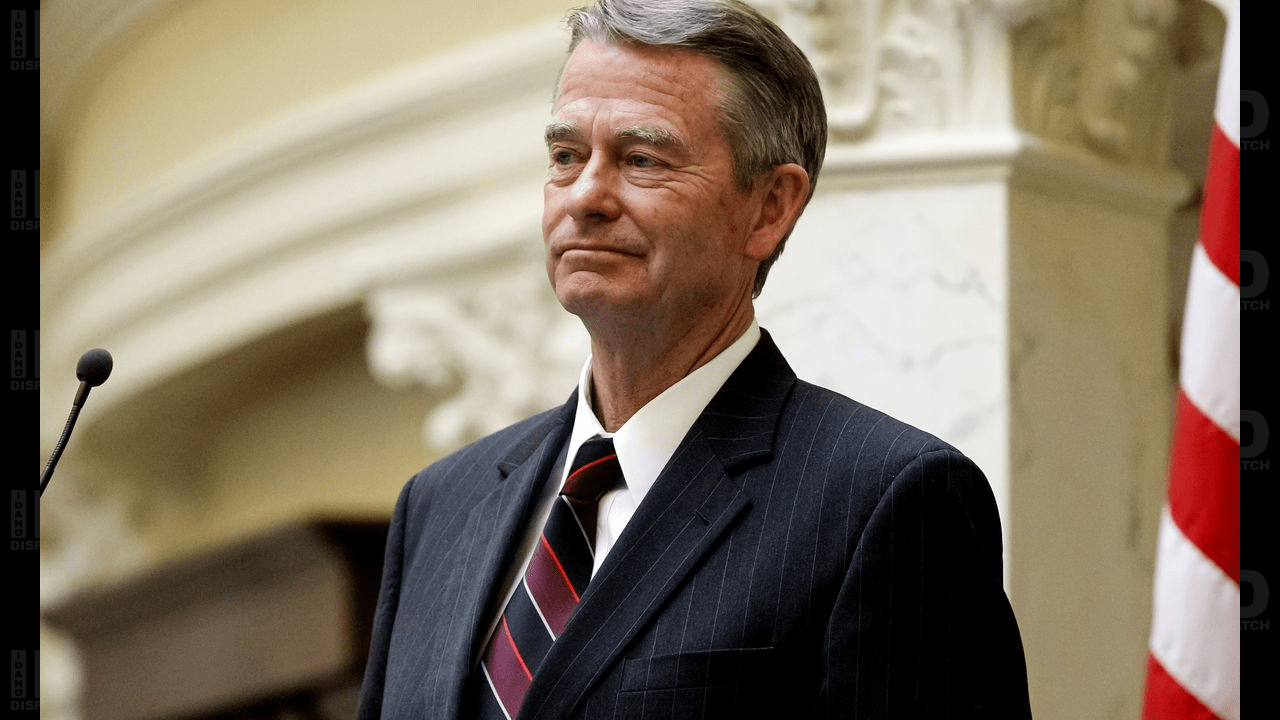

Press Release: January revenues blow past projections again, demonstrating Idaho’s continued economic strength

By Press Release • February 7, 2021The following Press Release was sent out by Governor Brad Little on January 5th, 2021:

Boise, Idaho – Idaho’s economy continues to strengthen, with Idaho leading states for the best financial shape and January revenue figures beating the forecast by $58.5 million. It marks the seventh straight month that the state’s economy outperformed projections.

“An open economy, relentless focus on fiscal conservatism, quick action throughout the pandemic, and Idahoans’ preventive actions against COVID-19 have positioned Idaho with the strongest economy in the nation and a historic record budget surplus,” Governor Little said.

AdvertisementThe Division of Financial Management released the January tax revenue report today showing Idahoans are working and engaging in the economy, with sales and income taxes coming in well above forecast. The report is available at https://dfm.idaho.gov/

publications/eab/gfrr/ gfrr2021/gfrr_feb2021.pdf. Governor Little’s proposal for the record budget surplus is called “Building Idaho’s Future,” and it is making its way through the Idaho Legislature right now.

Governor Little is proposing more than $450 million in tax relief – among the largest tax cuts in Idaho history – and strategic investments in education, transportation, broadband, water projects, and other areas. In addition, his “no frills” budget proposal for Fiscal Year 2022 leaves a prudent, bolsters rainy-day funds, and reflects his continued priority on education, including our valuable teachers.

AdvertisementIdaho has been able to lead the nation in financial solvency through conservative revenue forecasting, setting aside healthy reserves, limiting government spending, and rolling back state regulations.

Governor Little emphasized the need for Idahoans to wear masks, keep their distance from others, and take other preventive steps to slow the spread of COVID-19 to keep our economic momentum going.

# # #

AdvertisementRelated posts:

Idaho Attorney General Files Suit Against Ranked-Choice Voting/Top Four Primary Ballot InitiativeIdaho Democratic Party Pledges Delegates to Vice President Kamala Harris; Idaho GOP Responds to Biden Stepping DownState Freedom Caucus Network Denounces 3 Idaho Lawmakers in Dispute Over Group Membership

Tags: Brad Little, Building Idahos Future, Covid-19, Tax Relief

6 thoughts on “Press Release: January revenues blow past projections again, demonstrating Idaho’s continued economic strength”

Leave a Reply

Just can’t trust the little gov.

And I wonder what COVID money has been slushing around, out there.

Where it’s coming from, and what it goes to.

Idaho gets $100, 000 per COVID “case”. Whether the “case” puts any burden on the medical system, or the “case” has no symptoms.

Wonder where all that money has gone. I didn’t get any, did you???

Oh Barb, you’re adorable,

You may want to turn up the volume in your echo chamber to ensure that nothing from the outside gets in.

P.S. You may have to ask a friend to explain this for you.

Give immediate state tax credits to everyone that makes less than $100,000 per year. No pork barrel pet projects should be funded. That money is always down the toilet.

I agree with the Governor even if I shouldn’t. Holding funds for a rainy day is a great Idea. But keep Us a strong republican State. We don’t need handouts. We need to work pay taxes on wages but not on Food or Private property less than 100 Acres…

My two cents since I broke silence in a earlier post, If the governor was a leader he would set down with the Teachers Union, and tell them to get with the program, they belong in the class room so struggling Idaho Families can get back to work. He also needs to take a stand on he 1619 project and let it be know, that Idaho is a constitutional state, erasing history or amending it to fit your agenda is not going to fly. Attempts by the Teachers Union to extort time away from class rooms only puts Idaho Educational system further behind. And parents jobs at risk by attempting to juggle a class schedule that is inconsistent with most parent work schedules. Not to mention the Day care providers who are under strict guidance to only have X amount of X age children present at any given time.. I really don’t think they understand. Consider giving school vouchers, and allowing teacher to stay at home with out pay would be great start. The property taxes are killing those on fixed incomes, with taxes being increased on my property over $600.00 dollars in one year. Thats fifty dollars a month. And then they are considering a full tax increase on top of the all ready large budget surplus? The Governor promised the Grocery tax would go away, honor your words, not be a Biden, Little..

Complete lack of integrity from Gov. Little. Our kids are suffering and failing school, business have gone bankrupt yet you won’t do A DAM THING ABOUT IT!!! TELL THE TEACHERS TO WORK FULL TIME, IN PERSON. OPEN UP THE DAM SCHOOLS!!!! THEY GOT A TON OF OUR MONEY FOR DOING A HALF ASS JOB!!! ITS EMBARRASSING TO HAVE A GOVERNOR WHO WONT DO THE RIGHT THING FOR OUR RED STATE! WE WONT FORGET THIS BRAD!