Gov. Little Signs Largest Income Tax Cut Bill Into Law. Citizens React.

By Greg Pruett • May 13, 2021Governor Brad Little has signed House Bill 380 into law.

The bill is one of the largest income tax cuts in Idaho history. HB 380 provides $163 million in ongoing tax relief and one-time tax relief of $220 million.

Idaho lawmakers passed the bill almost entirely along party lines, with Sen. Dan Johnson (R-Lewiston) being the lone Republican in either chamber to vote with all Democrats voting against the bill.

Little said as part of his Press Release on the bill,

I appreciate my partners in the Legislature for sharing my commitment to tax relief for our citizens. In Idaho, we’re able to achieve historic tax relief because we responsibly manage our budgets. The strength of our economy proves fiscal conservatism works.

Now that the bill has been signed into law, citizens are reacting to the bill’s passage.

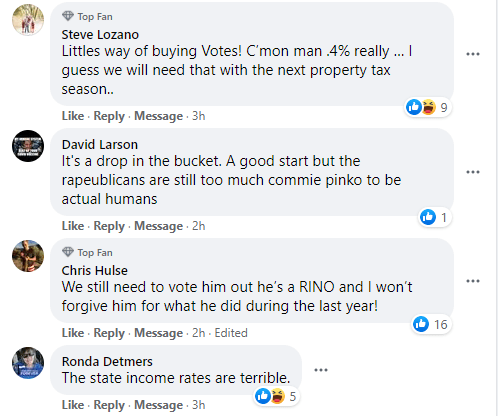

Idahoans on social media reacted to the news, with some saying it is much-needed relief and others saying it will only benefit the rich. Other Idahoans say that it doesn’t do enough and that Little is only doing it for political gain.

Here are some screenshots of some of the comments on the Idaho Dispatch Facebook page when we asked how they felt about the bill:

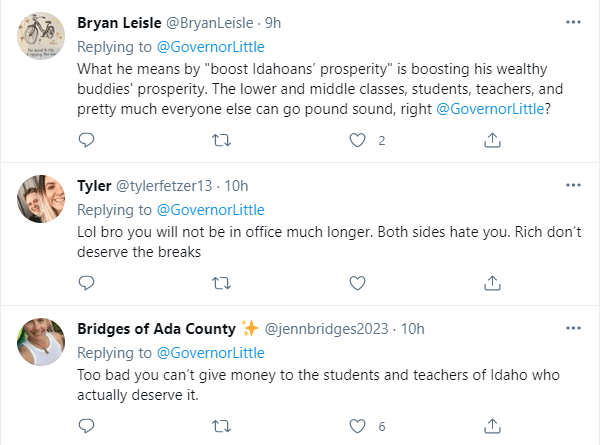

Twitter users also appeared to be displeased with the passage of HB 380. Here are some of the comments from Little’s Twitter feed:

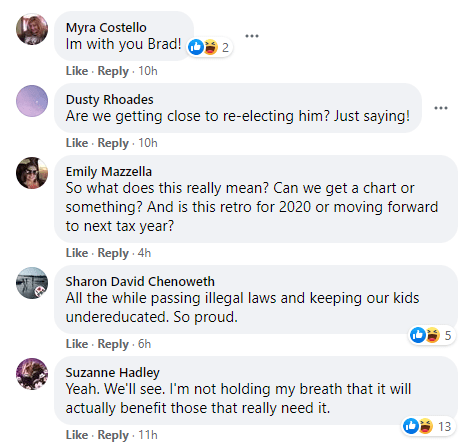

On Little’s Facebook page, many commenters also appeared displeased with HB 380 and felt that the legislature should have look at removing the grocery tax or decreasing the sales tax.

However, there were some comments supportive of Little signing HB 380. Here is one screenshot of some of the comments from Little’s Facebook page:

HB 380 was sponsored by Sen. Steve Vick (R-Dalton Gardens) in the Senate and Rep. Steve Harris (R-Meridian) in the House. Idaho Dispatch reached out to both of them for comment but they have not yet responded to our inquiry.

Here is the “Statement of Purpose” for the bill as listed on the legislative website:

This 2021 Tax Relief bill reduces all income tax brackets, reduces the number of brackets to 5, and sets the top individual and corporate tax bracket to 6.5% retroactive to January 1, 2021. This provides Idahoans with $162.9 million in ongoing tax relief. This bill also provides a one-time sales tax/income tax rebate, returning $220 million to Idaho taxpayers. A rebate check will be sent to 2020 personal income tax filers providing a minimum amount of $50 for each taxpayer and dependent or 9% of income taxes paid in 2019 whichever is greater.

Rep. Ron Nate (R-Rexburg) told Idaho Dispatch about the passage of the bill:

The income tax cut is the largest tax cut in Idaho history. It is still not enough though. Idaho should not be one of only five states to fully tax groceries.

We will work hard to provide even more tax relief for Idaho families in the next legislative session.

Idaho Dispatch also reached out to Rep. Lauren Necochea (D-Boise), Rep. Chris Mathias (D-Boise) who deferred the question to Necochea, Rep. Brooke Green (D-Boise), and Rep. John Gannon (D-Boise) for comment but have not received a response at this time.

Do you believe this tax relief bill is enough or should more be done? Or does Idaho need to use the tax money for something else?

Let us know what you think in the comments below.

Tags: Brad Little, Facebook, HB 380, Ron Nate, Tax Cuts, Twitter

You don’t tax The People’s food! You don’t tax The People’s air or water.

Let’s cut Taxes: Income, Fuel, Property, Municipality Taxes etc. etc…..Let’s CUT TAXES!

The House, The Senate, The Judicial and the Executive Branches duties are to Cut Spending, Uphold the Constitution, and stay out of The People’s lives when and wherever possible.

Let’s crush Idaho’s archaic Medical, Insurance and School systems and replace them with common sense knowledge, individual choice, and freedom of choice.

With Strong Bureaucracy Limitations and Common sense spending measures applied, all taxes might well be cut in half.

Yea! Idaho Seven. I live on SS only. worked 38 yrs before retirement plans like the Government workers get. Schools waste money also by not working year-round, I pay a big amt of money for medicare out of my SS. Because they have cheated putting immigrants on SS if they are of the age to qualify. I think we have no common sense left in anyone now. I don’t want my grandchildren to have to apologize for being white. I had my children read to kill a mocking bird.

Shame on the book burning in America…

Indeed.

$50.00!!!!!

Lol lmfao lol

$50.00!!!!!!lol

And property tax exemption of only 25k?

What a joke. Broken promises.

Looks like we need a Jarvis Ammendment by WE THE PEOPLE!!!!!

Prop 13 passed in the 1980‽ It states that property taxes are calculated AT THE APPRAISED VALUE WHEN PURCHASED.

The taxes stay the same EACH year. There is not a re appraisal every year.

What do you think?

Property taxes means that the government owns our property. I can’t understand the ignorance of the Idahoans. Mostly very simple minded people.

Brad Little is a slime ball. He does NOTHING to restore Constitutional authority to the Legislature. He does NOTHING to restore the impartiality of the so-called Justice system and courts. He does NOTHING to END THE EMERGENCY that is NOT an emergency. He does NOTHING to get rid of the Grocery Tax. Then he comes along and tries to pretend HE is responsible for lowering our taxes, all the while making Idaho even more in debt to and under the control of the Federal Government. He is all RINO, pure and simple. Does he really think he can fool the People of Idaho now? Wow!

If there’s one place Idaho truly falls behind other strong Red states, it’s tax policy. We’re in CA and have dreamed of retiring in ID for years (I know… I know… but if it’s any consolation, we’re as hardcore right as it comes and we’re fleeing to SUPPORT your politics and your culture, not change it). But if you want to see some sick irony… when we’ve done our income tax calculations, Idaho will actually cost us MORE in state income tax than CA does. Let that sink in. CA has a higher MAX tax bracket than ID, but ID’s kicks in at a much lower tier. Looking around the country at states like TX, FL, TN, etc. that all make it work with NO income tax whatsoever, it’s hard to believe a state like ID is still up there with high income taxes on middle class families and escalating property taxes without a Prop 13 protection in place. I keep waiting to hear ID is going the route of WV and just eliminating the income tax altogether, but this drop in the bucket from Little isn’t even close. Sad.

Here Comes Janice !

Bye brad.

Ditto! let’s work hard for her.

Red West is right. My relative, who is retired, looked at moving to Idaho from Washington state. She realized that she could not afford to! Instead, she moved to a generally conservative state on the east coast.

Idaho is not the state to move to if you have anything more than just a SS check when you retire. It is a great state if you have no money and are looking for welfare. People around here like to do winter coat drives, food drives and such. Don’t move here if you have been faithful about saving up for retirement.

Janice is not as conservative as Humphrey!

https://edforidaho.com/

ROFLMAO

This tax cut does nothing to help those in the lower income brackets. This is governor chicken Little’s way of telling the hard working folks in Idaho to go pound sand. This is the same governor and legislature who promised before the last election to repeal the grocery tax and what happened. Typical of a government run by Lobbyists and crony elitists. You want change get rid of Little, Chuck Winder, PattiAnn Lodge, Fred Martin, Abby Lee, Jeff Agenbroad in the 2022 election. If you want change you need to tell them with your votes. Idahoan’s have been too complacent when it comes to elections and they need to start understanding that if they don’t get out and vote nothing will change.

House Majority Leader Mike Moyle spoke to our group today about the legislative session and other topics including taxes. Tax policy in Idaho is Draconian. It hurts people in the lower wage scales the most. Other states may have higher marginal income tax rates but they kick in at much higher incomes. In Idaho, the top rate is lower but kicks in at much low income levels so everybody suffers.

Property taxes are the purview of the counties and not the state and are the main source of funding for county and city budgets. There is little the legislature can do to curb city and county budgets which drive their insatiable need for more taxes. Property tax rates will not come down until we the people elect responsible conservatives to run our cities and counties and get control of their budgets.

The grocery tax is a delicate issue. It brings in a sizable chunk of money for the state. Idaho will have a grocery tax until we elect a real conservative governor how will lead the fight to repeal it. It will be a battle but one we must fight.

Everybody has to eat and everybody needs a roof over their. If you rent you are paying your share of your landlords property tax bill. If you own you get hammered annually when the value of your home goes up. It is unconscionable that long time Idaho residents cannot afford to stay in there homes because of their property taxes. How can our county officials sleep at night nothing they are putting people out of their homes? It’s disappointing to know that we have our own swamp here in Idaho.

Differing opinions are one thing. Purposely hurting people with your tax policies and political agendas are an entirely different matter. Fixing these problems will not be easy and it will take time but it can be done. First, register to vote. PLEASE! Next, do a little homework and figure out who you can trust in government to look out for your best interests and support them at election time. Reach out to your legislators and let them know about your concerns. Or thank them for doing a good job for their constituents. Talk to your friends and neighbors about what is important to you. If you are motivated to do more get active locally with your party. The opportunities are there and it is time well spent. Support local candidates you like. Volunteer to be a poll worker and help keep our elections fair and honest. Remember, we get the government we vote for.