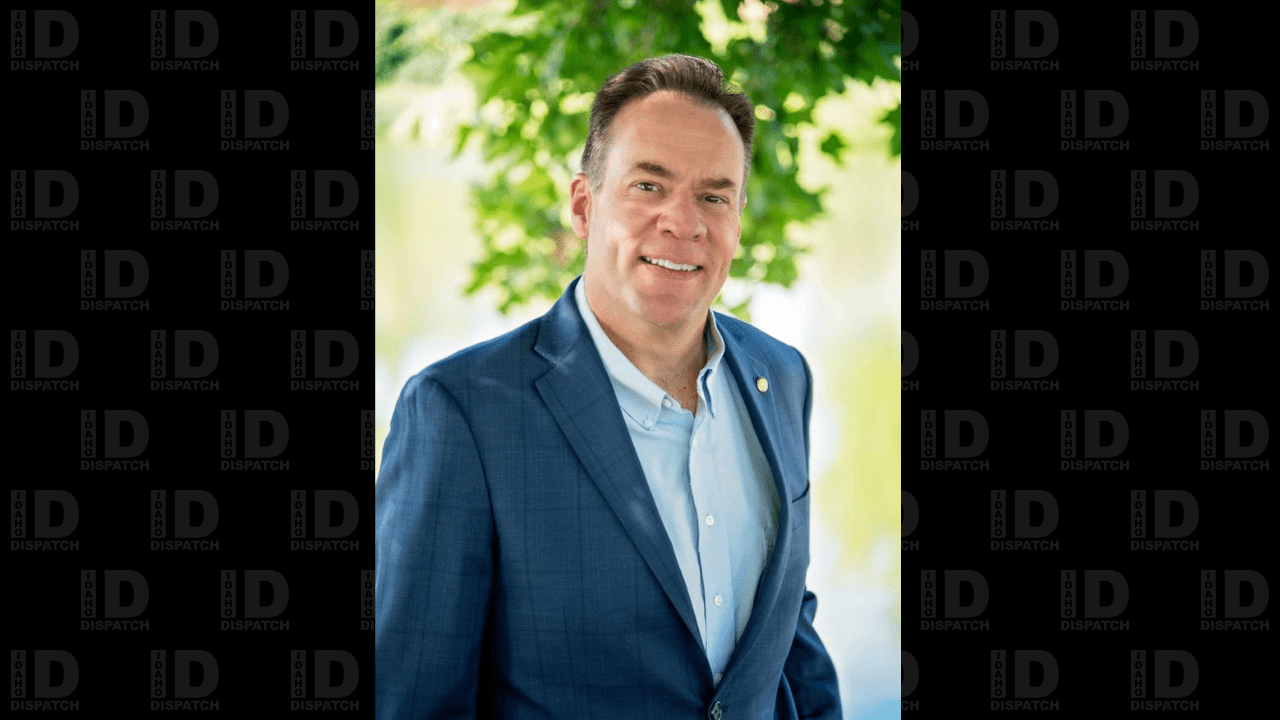

Press Release: Fulcher Introduces Legislation to Eliminate Income Taxes on Overtime Pay

By Press Release • July 26, 2024The following Press Release was sent out by Congressman Russ Fulcher. Please note that Press Releases do not necessarily reflect the views and opinions of those at the Idaho Dispatch.

“WASHINGTON, D.C. — Today, U.S. Congressman Russ Fulcher introduced the Keep Every Extra Penny (KEEP) Act to address the ongoing labor shortage by eliminating income taxes on overtime pay.

This legislation, which has never been attempted at the federal level, comes as inflation remains above the Federal Reserve’s target rate for the 39th consecutive month.

Advertisement“Our nation is facing unprecedented challenges due to workforce shortages and continued high inflation levels. Millions of Americans are looking for financial relief as the rising costs of everyday goods have soared 20 percent since President Biden assumed office. By eliminating income taxes from overtime pay we can help alleviate this burden for hardworking folks by letting them keep more of what they earn while continuing to safeguard government programs such as Medicare and Social Security,” said Congressman Fulcher.

Background:

The KEEP Act will eliminate income taxes rather than payroll taxes to ensure that Social Security, Medicare, and unemployment funding remain unaffected.

AdvertisementIndividual income taxes accounted for 49% of all federal revenue in 2023 according to CBO data.

Americans currently eligible for overtime, as defined in the Fair Labor Standards Act under section 7, will be covered under the KEEP Act.

The Fair Labor Standards Act lead to the establishment of overtime and the 40-hour work week during the Great Depression to provide relief to both the employee and employer. The KEEP Act aims to amplify this relief while our nation faces similar circumstances.

Read the full text of the bill here.

###”

Tags: CBO, Income Taxes, KEEP, Overtime Pay, Russ Fulcher

6 thoughts on “Press Release: Fulcher Introduces Legislation to Eliminate Income Taxes on Overtime Pay”

Comments are closed.

This seems all well and good to me, however…how about pushing for legislation to eliminate, once and for all, the obscene tax on food? And property tax relief…how about that?

These seemingly random efforts to preserve Social Security, etc. are needed…I don’t want to understate that. But everyone has to eat, and with food prices being the elephant in the room, I personally think taxing it is an abomination to consumers that are challenged just meeting the costs of living by meeting expenses without taxing what we all need…just to live from day to day.

The list of means whereby government drains the pockets of taxpayers is far too long…the cries for help is reaching desperation levels, in my opinion.

Must be an election year.

So we are so concerned about social security but we never made any mention about changing it from the general fund.

In the state of Idaho property value has increased at least double so that means property tax collected has doubled. not to mention the state population increase could add another 25% and on top of all that the wages in Idaho have jumped at least 35%.

So all that being collected the only thing to change (joke) only talk about for elections is eliminating overtime taxes. nothing about federal taxes, gas taxes, real estate taxes, food taxes, going to the park taxes, phone taxes, and you know this could go on forever.

Has the same smell as a democrat. BS!

The dumbed down TV watching voters keep reelecting their politician thieves.

While I’m glad to see “where’s Waldo Fulcher” saying something I’d much rather hear him talking about getting rid of the food tax and lowering the gas tax. We’re retired and on a fixed income so do something that helps all Idahoans.

Get real Labrador property taxes are the biggest crime ever foisted on the dumbed down TV watchers we really do not have the right to own real, property .